Medicare Supplement Insurance

Discover Affordable Coverage Options

Find a Medicare Supplement plan that suits your healthcare needs and budget. Fika Insurance Group is committed to helping you secure coverage that fills the gaps in Original Medicare. Whether you’re looking to reduce out-of-pocket costs or need coverage for services that Medicare doesn’t fully cover, we’re here to guide you through your options.

Why Choose Fika Insurance Group?

- No Hassle, Just Help: We value your privacy—no unsolicited calls or emails, just transparent and free quotes.

- Local Expertise: Serving Greenwood, SC, and the surrounding areas, we understand the needs of our community and are here to help you make informed decisions.

- Comprehensive Guidance: Our experienced agents specialize in Medicare Supplement plans, ensuring you find the coverage that’s right for you.

Explore Your Coverage Options Today

Contact us to learn more about how a Medicare Supplement plan can benefit you.

Have Questions?

Fika Insurance Is Here For You!

The Features of Medicare Supplement Plans

If you choose to rely solely on Original Medicare (Part A and Part B), you could still be responsible for significant out-of-pocket costs, including copayments, deductibles, and coinsurance. By purchasing a Medicare Supplement (Medigap) policy, you can gain peace of mind knowing you’ll have help covering these expenses.

What a Medigap Insurance Policy Offers:

- A Wide Range of Standardized Plans: Medigap plans are available in various standardized options, labeled from Plan A to Plan N. Each plan provides a different set of covered services to suit your needs. Note that certain plans, such as Plans E, H, I, and J, are no longer available for purchase.

- Predictable Costs: Medigap plans offer predictable costs, helping you avoid unexpected out-of-pocket expenses and providing financial stability.

- Enhanced Coverage with Prescription Drug Plans: When combined with a Medicare Prescription Drug Plan (Part D), Medigap policies can offer more comprehensive coverage, ensuring you’re well-protected.

- Legal Protections: Federal and state laws safeguard your rights with Medigap policies. As long as you pay your premiums on time and avoid material misrepresentations when applying, your coverage is guaranteed for life.

With so much information available today, it’s easy to confuse what qualifies as a true Medigap policy. To clarify, the following insurance plans are not considered Medigap plans:

- Medicare Advantage Plans (PPO, HMO, or Private Fee-For-Service Plans)

- Veterans’ benefits

- TRICARE

- Long-term care insurance plans

- Employer or union insurance plans, including the Federal Employees Health Benefits Program

- Medicare Prescription Drug Plan (PDP)

Medigap plans are designed to fill the “gaps” in Original Medicare coverage, but they generally do not cover services like long-term care, vision or dental care, hearing aids, or eyewear. However, Medigap plans do provide coverage for several key areas, including:

- Part A Coinsurance: Covers up to an additional 365 days after Medicare benefits are exhausted, including copayments or coinsurance for hospice care.

- Part B Coinsurance or Copayments: All Medigap plans must cover at least the Medicare Part B coinsurance or copayments, as well as up to 3 pints of blood per year.

Additional coverage may include:

- Skilled nursing facility care coinsurance

- Emergency care during foreign travel

- Excess charges under Original Medicare’s Part B

- Part A deductible

Medigap policyholders also enjoy the freedom to choose any doctor or hospital that accepts Medicare, regardless of the specific plan or insurance carrier.

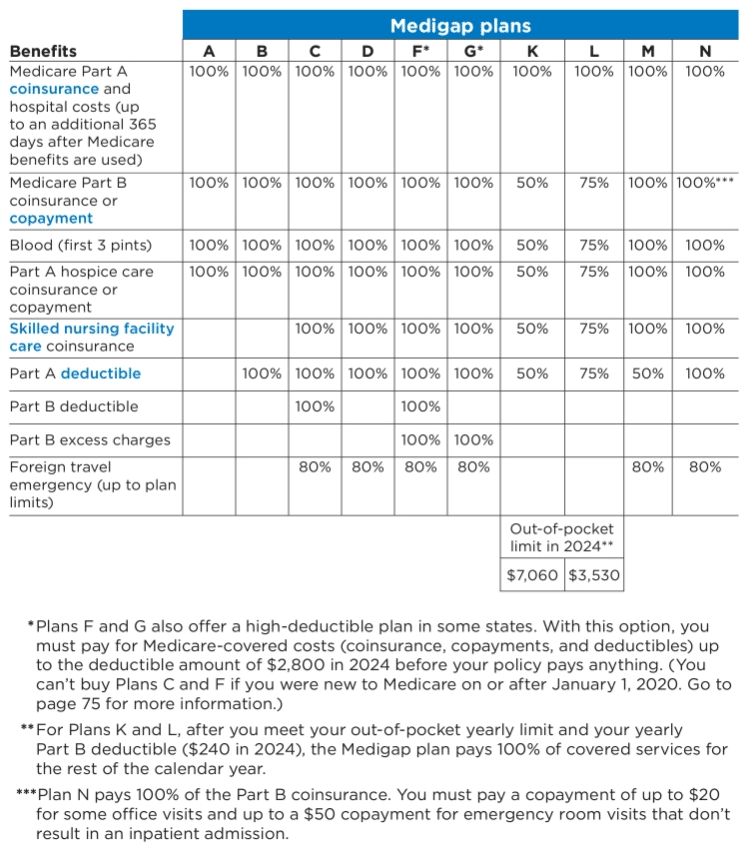

With various options available, understanding the differences between each Medigap plan can be challenging. Complete side-by-side comparison of plans. Please note that if you live in Massachusetts, Minnesota, or Wisconsin, Medigap plans may differ from those offered in other states.

G-2 Certified

Your Assurance of Quality and Trust

Fika Insurance Group is proud to be G-2 Certified, a mark of our commitment to excellence and integrity in the insurance industry. This certification is your assurance that we adhere to the highest standards of quality and trust, providing you with reliable and trustworthy insurance solutions.

Choosing a Medicare Supplement (Medigap) Policy

Are you considering a Medicare Supplement Policy but unsure which plan best suits your lifestyle and healthcare needs? Contact us today to speak with one of our knowledgeable professionals who can guide you through your options. You can also [click here] to compare the available plans in your area.

Another option worth exploring is a Part C Medicare Advantage Plan. These plans often offer additional benefits and can help manage your overall Medicare costs.

Stay Updated with the Latest Insights

Our Most Recent Articles

Chris J

fikainsurance21

Unlock Your Free

Medicare Guide

The team at Fika Insurance Group simplifies the complex world of insurance for you. Whether you need clarity on Medicare, Life, or Health Insurance, we are here to help. By signing up for our monthly newsletter, you'll receive our free audiobook, "Understanding Medicare: Your Complete Guide." Stay informed with expert insights and tips, and make confident decisions about your coverage.